Redhat 180 Day Bond - 10% Return

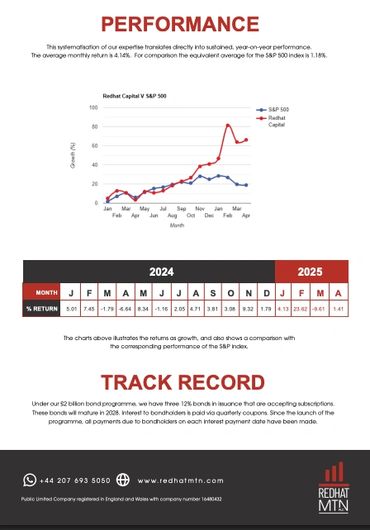

Achieving Performance

Redhat’s trading philosophy encompasses a wide range of asset classes, and hedging strategies including commodities, futures & options, indices, arbitrage and FX.

Discover The 180 Day Bond that pays you 10%.

Downloads

Download the 180 day bond here.

Read why short term bonds can help you.

Why a 180-Day Redhat Bond?

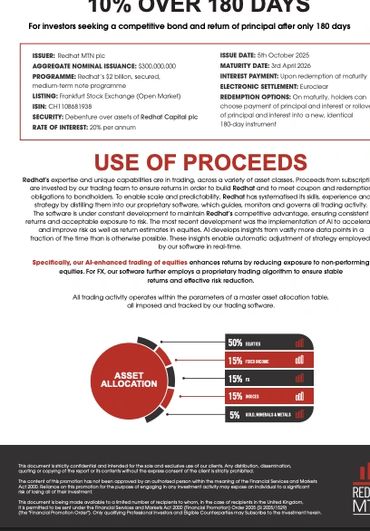

Fixed income, short timeline, clear choices at maturity.

The Redhat 180-Day Bond targets a fixed coupon over a six-month term, giving you a defined date to take funds out or roll into the next 180-day tranche (subject to availability and suitability). For investors managing cash over 6–12 months, it’s a disciplined way to earn income without tying money up for years.

What investors like

- Short duration: six months reduces interest-rate (duration) risk versus long bonds.

- Predictable cash flow: fixed coupon helps plan around tax, property, or business needs.

- Defined exit: redeem at day 180 or elect to roll over into a new term.

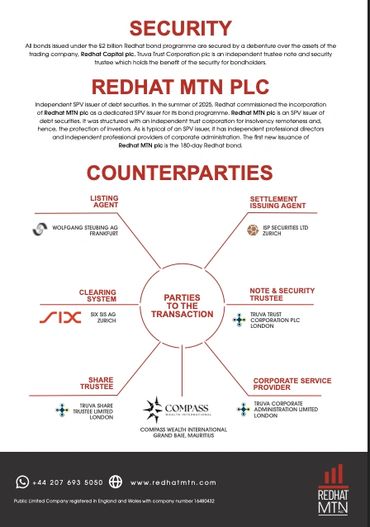

- Security framework: issuer states bonds in the programme are secured by a debenture over operating assets, with an independent security trustee holding the benefit of that security for bondholders.

- Portfolio balance: a steady fixed-income sleeve alongside equities and cash.

Good fit for: expats and professionals holding cash for near-term goals (6–12 months) who want fixed income and a clear maturity date.

Next step:

Request the 2-page summary + 10-minute suitability check and see if the 180-day note fits your plan.

Disclosure: This is information only, not investment advice. Capital at risk. Returns are not guaranteed. Eligibility, terms, and availability vary by jurisdiction and investor classification. Always review the term sheet, risk factors, security/trustee documents, coupon schedule, and latest financial statements before investing.

Updates .

Contact Us

Jamie@compasswealthinternational.com

We love our customers, so feel free to visit during normal business hours.

Compass Wealth

250 Bishopsgate, London, UK

Hours

Open today | 09:00 am – 05:00 pm |

Keep in Touch

Keep in touch of all new Bonds you might want to look at.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.